Sales and use tax computation

Use tax and vessel registration requirements. Youll find rates for sales and use tax motor vehicle taxes and lodging.

Income Tax Computation Format Pdf Simple Guidance For You In Income Tax Computation Format P Tax Forms Income Tax Income

Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington.

. For retail sales and use tax assessments issued on or after October 2 1999 Virginia Tax will allow the taxpayer to calculate an Alternative Method of computing the use tax ratio that takes. This calculation only applies to sale transactions arising. Job in Seattle - King County - WA Washington - USA 98127.

The amount of sales tax to be paid is calculated by multiplying the amount paid for goods or services by the tax rate. Look up a tax rate. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize.

Sale amount 1438 the tax rate 65. Sales and use tax computation Saturday September 3 2022 Edit. Floridas general state sales tax rate is 6 with the following exceptions.

Quickly learn licenses that your business needs and. Tips for Completing the Sales and Use Tax Return on GTC. Sales Use Tax Import Return.

Streamlined Sales and Use Tax Project. By statute the 6 sales and use tax is imposed on a bracketed basis. Hit enter to return to the slide.

The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Apply more accurate rates to sales tax returns. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

Filing and Remittance Requirements This is a link to Rule 560. Get information about sales tax and how it impacts your existing business processes. Local taxing jurisdictions cities counties.

Multiply by the sale price. How to Calculate and Pay Estimated Sales and Use Tax. Texas residents 625 percent of sales price less credit for.

To use this formula you first need to add up all applicable sales taxes. The following sales tax calculation. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Sales Use Tax. Add up all the sales taxes. How o Calculae and Pay Esmaed Sales and Use Tax.

The sales tax is comprised of two parts a state portion and a local. Ad New State Sales Tax Registration. Businesses and Self Employed.

The Nebraska state sales and use tax rate is 55 055. Articles purchased for use in this state are. Add the sales tax to the sale price.

The amount of tax due is determined by the sale price in relation to the statutorily imposed brackets. The Nebraska state sales and use tax rate is 55 055. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

If only the state sales or use tax of 6 applies divide the gross receipts by 106 as. General Tax Adminisraon Program. Sales Use Taxes information registration support.

Address below and get the sales tax rate for your exact location. In transactions where sales. Sales and Use Tax Leader.

Use tax applies to the use of articles within Washington acquired without paying sales tax. Rates Due Dates. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

Use the sales tax formula to find the sales tax amount and the final sales price the customer owes. Gather local sales tax rate information. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

The use tax is a back stop for sales tax and generally applies to property purchased outside the state for storage use or consumption within the state.

How To Calculate Sales Tax In Excel Tutorial Youtube

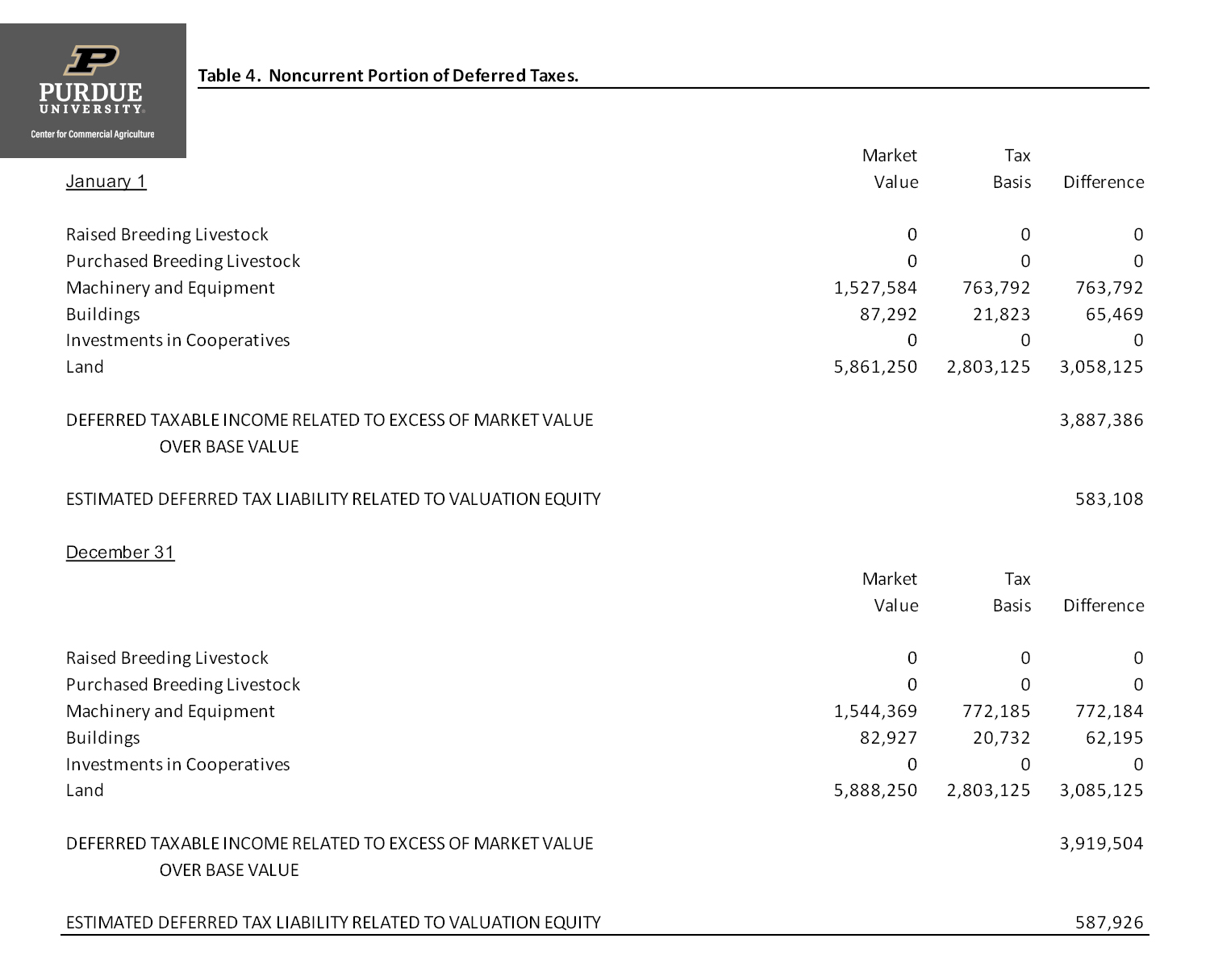

Computation Of Deferred Tax Liabilities Center For Commercial Agriculture

Money Task Cards Making Change Adding Tax Percent Of Sale Adding Tip Task Cards Money Task Cards Math Task Cards

As Per The Changed Rules Notified Under Section 234f Of The Income Tax Act Which Came Into Effect From April 1 2017 Income Tax Filing Taxes Income Tax Return

Taxable Income Formula Examples How To Calculate Taxable Income

Small Business Tax Deductions Small Business Tax Business Tax Deductions

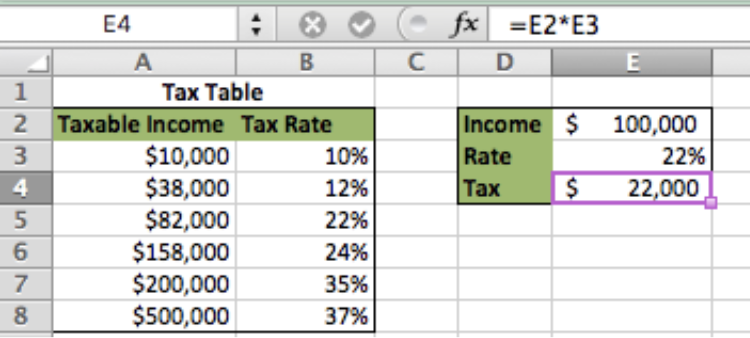

How To Calculate Sales Tax In Excel

Small Business Tax Deductions Small Business Tax Business Tax Deductions

How To Calculate Sales Tax In Excel

Sales Tax Calculator

How To Calculate California Sales Tax 11 Steps With Pictures

An Exclusive Solution For All Your Tax Filing Needs Features That Help You Make Tax Filing 100 Accurately Spect Filing Taxes Income Tax Return Tax Software

Excel Formula Income Tax Bracket Calculation Exceljet

Excel Formula Two Tier Sales Tax Calculation Exceljet

How To Calculate Sales Tax In Excel

Excel Formula Basic Tax Rate Calculation With Vlookup Excelchat

Spectrum Is Designed To Fully Automate The Process Of Tax Computation And Return Preparation Save A Lot More O Tax Software How To Apply Chartered Accountant